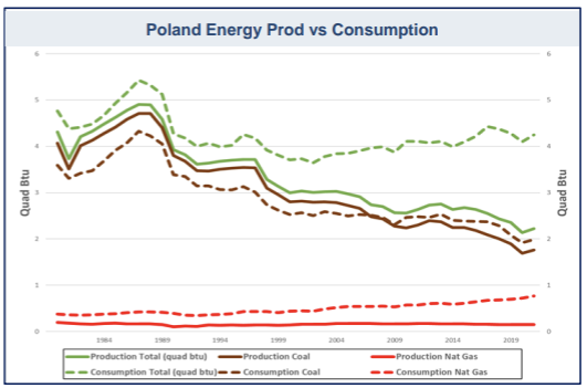

European Natural Gas Supply and Demand

Approximately 25% of the European energy matrix is comprised of natural gas. It is becoming increasingly important as European governments have introduced policies to reduce their dependence on nuclear power and coal, and since the Ukraine War to replace imported gas by pipeline from Russia.

Domestic supplies in Europe are in decline as the legacy gas fields are depleted. Natural gas is imported from the US and Qatar as LNG, by pipeline from North Africa, and pipeline from the Norwegian, UK and Dutch North Sea. Prior to the Ukraine War and the cessation of supplies by pipeline from Russia, Russian natural gas imports accounted for approximately 42% of Europe’s gas demand.

Gas pricing in Europe is significantly higher than North America with pricing driven by the cost to import LNG from the USA. Current (March 2025) prices at the Dutch TTF trading hub are about US$10-12/mcf.

Polish Natural Gas Market

Prior to the Ukraine War, 60% of Poland’s natural gas demand was met by imports of natural gas by pipeline from Russia through Ukraine. That supply has been largely replaced by gas delivered into northern Poland by the Baltic Pipeline bring gas from the Norwegian North sea and by LNG imports from the USA.

Domestic production has been stable for about the last decade at about 400 mmscf/d from legacy gas fields originally discovered by the then state company Polish Oil and Gas Company (now Orlen) in the 1970’s and 1980’s.

Government priorities to replace Russian gas and reduce the use of coal in power generation. Coal reserves and production are in decline and extraction costs are increasing.

Furthermore, reduction of pollution from coal fired powered generation is a key government policy.

The Polish Government is encouraging the development of domestic Polish energy sources both from natural gas and renewable energy sources.

Low royalties, a low corporate tax regime comprise a stable political and regulatory regime that is attractive for energy development with attractive economics. Poland has excellent, accessible energy infrastructure of pipelines and electricity that will allow the expedient connection of new oil and gas discoveries and developments.

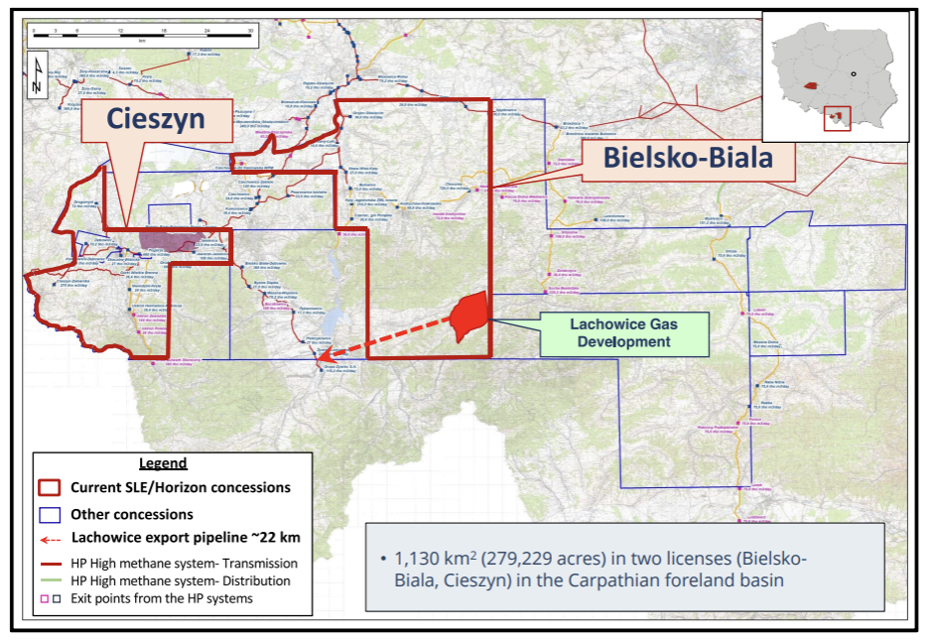

Horizon’s Concessions

Horizon holds a 100% working interest and is the operator of the Bielsko-Biala and Cieszyn concessions located in southern Poland.

Bielsko- Biala Concession (804km2)

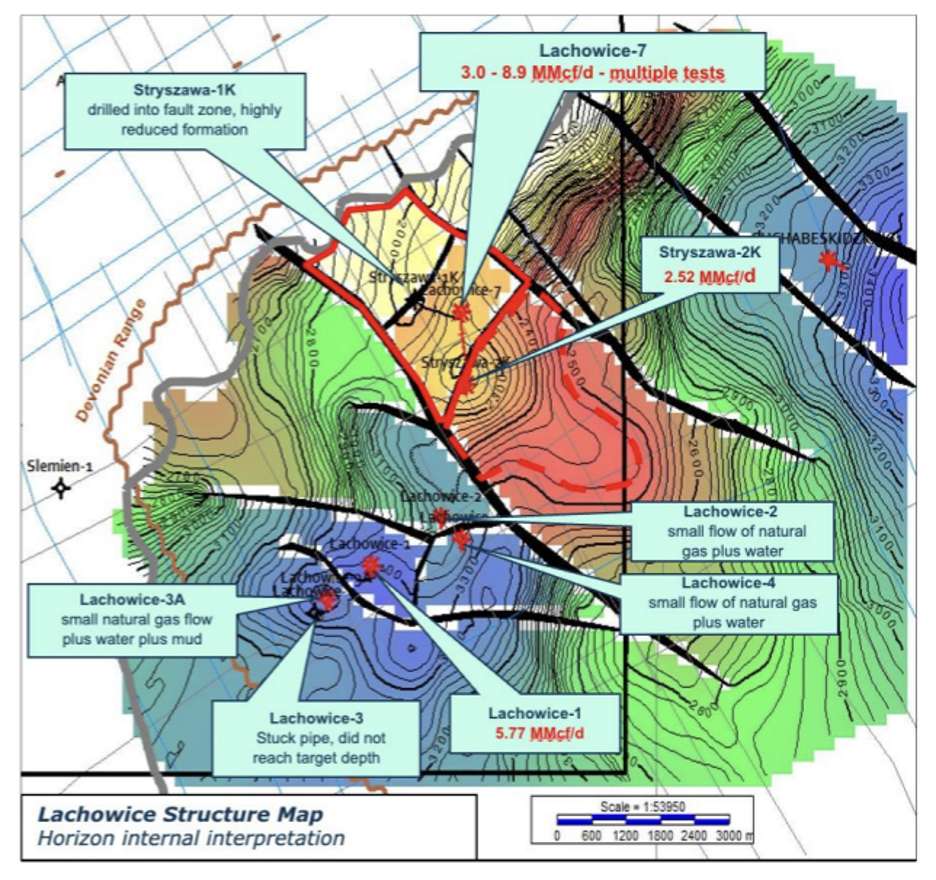

Bielsko-Biala contains the large undeveloped natural gas accumulation at Lachowice. Characterised by deeper (2,700-4,000m) Devonian aged naturally fractured carbonate reservoirs.

Horizon to execute an initial development plan to re-enter a suspended well and place on to production into a modular gas-to-power facility to generate electricity. Targeting first production and gas sales in late Q4 2025 or Q1 2026.

The Phase 2 development will comprise of a 3D seismic survey, development drilling and installation of a gas processing facility and pipeline to produce 40+ mmscf/d.

The company has a NI51-101 compliant Independent Reserve and Resource report for the Lachowice gas accumulation. See full details in the corporate presentation.

Cieszyn Concessions (326km2)

Cieszyn concession is located in the Carpathian Foreland Basin and on trend with a number of gas fields characterized by high quality, shallow (400 – 1,000m), Miocene aged sandstone reservoirs.

Potential for deeper Devonian and Carboniferous aged reservoirs similar to the Lachowice gas accumulation.